11. The Fossil Oil and Gas Producers (Continued)

So what would the implementation of Renewable Gas look like for a company like BP ?

It would be a transition happening on a number of fronts, as a result of a range of stressors.

Three trends are likely to continue in the chemistry of crude petroleum oil : where oils and their associated Natural Gas Liquids are being sourced from unconventional tight or shale formations, or from good quality newly-discovered conventional petroleum systems, the chemistry will be light, with valuable shorter-carbon-chain hydrocarbons – although there may be a high level of gaseous sulfur compounds incorporated in what’s extracted at the pumps in the field. The second trend will be where unconventional heavy oils, and older, depleting conventional heavy oils will continue to be produced, despite overly-heavy longer-carbon-chain hydrocarbons being the majority of the crude material, and there being a great burden from sulfur compounds – some very complex – and therefore in a liquid, rather than a gas, state. The third trend will be the increasing amount of sulfur compounds in some of the lighter oil stream and most of the heavy oil flow.

The two general streams of oils will need to be treated in different ways in refinery, and their eventual target products will also be different : lighter oils and gases will be used for blending into petrol-gasoline and for supplying the gas industry – where lighter hydrocarbons are either incorporated into Natural Gas supplies, such as the LNG supply chain; or bottled into cannisters for various applications, such as LPG fuel, propane fuel and so on. The heavy stream will be used for making diesel, air fuel and other distillates, gas oils and bunker fuels.

As the light oils get lighter, there will be more light hydrocarbons to deal with. This group includes methane and ethane. Most of the methane can easily be transposed into applications that would use Natural Gas, and some of the ethane, too; but what to do with the rest. There is a global industry developing around new supplies of ethane, for example, the fabrication of polymers – all the plastics we use.

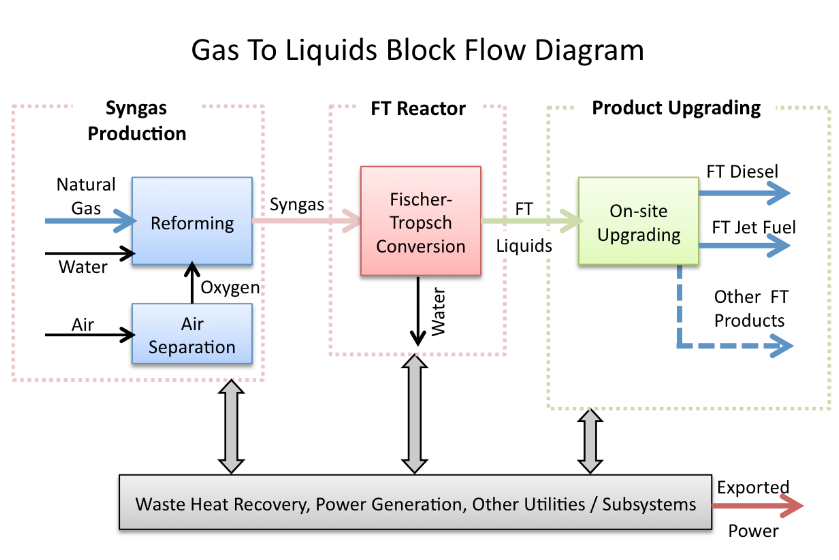

What’s wrong with this picture ? Well, to start with, methane and ethane are gases. That means they are not liquids, which means they cannot easily be used to produce liquid vehicle fuels, without re-forming or reforming the gases to make synthetic molecules with higher boiling points, so liquid. To synthesise liquid hydrocarbon fuels from hydrocarbon gases requires the additional use of energy, water and oxygen, which can be extracted from the air. Because an increasing fraction of the lighter oils is going to be gas, there will be a gas glut. The price of a range of hydrocarbon gases will stay low, and may even decrease. There will arise the question of how to increase the value of this surfeit of gases, and the answer will be twofold : make synthetic liquid fuels, and make hydrogen.

Ah, hydrogen. Why will hydrogen have so much value ? Because it can be used in a range of petrorefinery processing of the heavier oils.

As heavier oils get heavier, they will require increasing amounts of processing to make market-ready liquid fuels. One of the issues is the rising levels of sulfur compounds in the crude oil. As environmental standards in refinery have improved, increasingly, hydrogen has become the cure to a number of problems in purifying and reforming heavy hydrocarbon molecules. But hydrogen can be sourced from Natural Gas and the range of lighter, gaseous hydrocarbons coming from oil production.

Again, it looks like it all adds up, but there are a fistful of catches. You may have noticed that there is now a competition : those that process lighter oils will want to use the gaseous byproducts for synthesising liquid fuels, in order to maximise their value. Whilst those wanting to process heavier oils will want that same “refinery gas” to make hydrogen for all their hydrotreating, hydroprocessing, hydrodesulfurisation and so on.

Added to which, the supply of lighter oils might suddenly cease from a particular field or region, owing to economic imbalance, or rapid depletion after a wind-down in new drilling.

With the international regulations on sulfur adding a vice-like grip on the quality of heavier oil products, the petrorefiners could find themselves in a tight corner. They need hydrogen, but they don’t have any. Where can they get some ? Using wind, sun and water.

The sulfur in all the oils of the next several decades is going to become a slag heap of embarrassment. The yellow mountains of crystallised sulfur will just sit there, gradually oxidising and continuing to poison the atmosphere. Or burning, perhaps through military action, and creating toxic clouds and fallout everywhere remotely within range of the weather systems.

So I think the first signs that BP are taking Renewable Gas baby steps will be twofold : first of all, they will start buying or deploying renewable electricity assets. Why ? To have their own source of power for electrolysis of water, to make hydrogen for their refineries. The second step I think you’ll find will be that BP, like Shell, start to synthesise fuels.

One day, no liquid hydrocarbons will be mined from the ground : they will all be synthesised from renewable electricity, water, air and biomass.